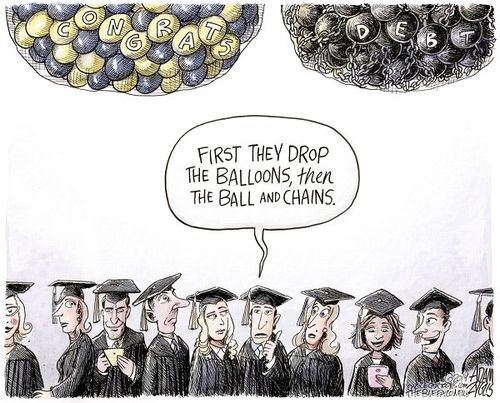

PROBLEM: We’re raising a whole generation that thinks debt is acceptable.

SOLUTION: We can teach children to be financially wise. Then they’ll “own” money instead of money “owning” them.

Does it concern you that the average U.S. household with credit card debt owes $15,654? Or that average households with car loans owe $27,669? Or that the average household with student loan debt owes $46,597?

And how about the sad fact that nearly 7 in 10 Americans have less than $1,000 in savings? When an unexpected need arises or an emergency hits, they’ll suffer hardship and loss.

You know, we can’t blame all of this on big government that taxes us too much or stupid government that depresses jobs and the economy. No, a strong, personal ethic on money, work, and savings is the key, and it’s developed young.

That’s why I urge you to train your children and grandchildren to have a right view of money, work, their needs, and their identity. Let me tell you how I was trained:

1. Money: When I was a child, I had to earn money by doing daily and weekly jobs around the house and yard. My small allowance was “payment,” and I knew it. Later, when I was earning more money, I got a small bank account and began socking away monthly income. Saving money and enjoying work eventually enabled me to buy a piano with cash at age 17 (and now I play the piano and compose for several minutes most evenings).

2. Work: At age 8, I began delivering newspapers two days a week with my older brother. I had to go to bed on time to get up early to fold and rubber-band papers and then get lots of exercise riding my bike and slinging papers onto people’s porches and driveways. Within a year, I got my own paper route. Looking back, it taught me industry and perseverance. And I hardly ever viewed work as bad, but learned to experience work as a good thing.

3. Needs: I’m a son of an expert “garage-saler,” and Mom bought used clothes for us mostly. Except for shoes, nearly all my childhood clothes came from garage sales and thrift stores. To her credit, Mom even bought used underwear for us boys, washing them in very hot water with bleach. All our material needs were met. I never had an electronic toy, but read books and played in the backyard and the street. Did I lack financially? No. But why, oh why, do I hear mothers in stores asking their children “What do you want?” Those careless words blur the line between needs and wants in a child, and train children to be selfish and foolish. Needs versus wants is a regular financial discussion in frugal homes. Today, I try to buy less than I need in order to avoid materialism and waste.

4. Identity: I didn’t learn my true identity in Jesus Christ until adulthood when I studied and believed God’s word. Over the years, lots of suffering and various “identity tests” have helped refine me (and I still have lots of room to grow). So today, I’m not very tempted to find my identity in money, possessions, status, race, or other people’s opinions. Instead, I want an identity that’s willing to be tortured and die for Jesus, if necessary. I want to “lose my life for His sake,” to be His obedient child and faithful servant, who loves Him and loves people, and to bear as much fruit as I can. Have you learned what I’ve learned, that avoiding a worldly identity will help you to be both frugal and generous?

To be completely candid, I’m so frugal today that I don’t have any car loans, no credit card debt, have clothes that are several years old, and have a goal of reaching half a million miles on my car. Am I weird? Perhaps. Am I financially stupid? No, I’m free from financial bondage. And along the way, I’ve learned more wisdom whenever I’ve repented of my foolishness and pride.

Check this out — here are my four-year-old shoes that I finally replaced with the exact same “model.” I put my shoes through the wringer! And I’m going to use a healthy insert to make the new shoes last as long or longer.

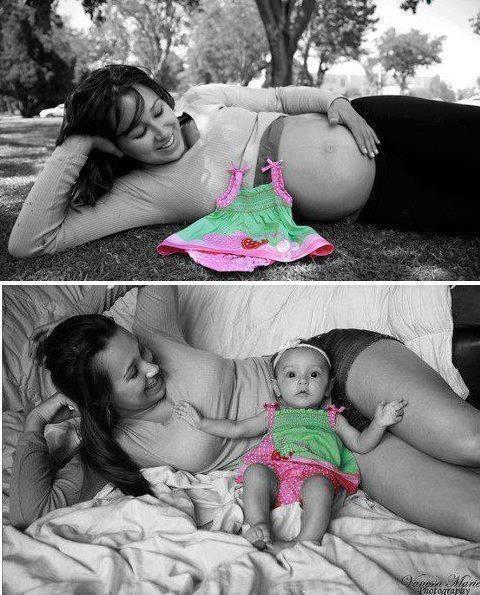

Hopefully, what I’ve shared will you encourages you to raise your children — and influence your grandchildren — to be hard-working, thrifty, debt-free adults. Building good character in regard to money, including teaching children that God owns it all, will pay you “dividends” as you watch your little ones grow and thrive.

Here’s a powerful way to teach your children that “money comes from work and about the importance of giving, saving and spending.” I encourage you to seize this opportunity!

The Joy of Work: As parents we must communicate to our children not only the necessity of working (Proverbs 13:4; 14:23), but also the benefits (Ephesians 4:28b). We make a terrible mistake if all we are able to instill in our children is an appreciation of employment for the sake of acquiring things (Proverbs 16:26). Work like everything else ordained of God is intended to affect our character. What we must communicate to our children is the “good” in work and the joy that it brings.

Teaching Values: A Work Ethic

RSS 2.0 Feed

RSS 2.0 Feed