In California, liars and thieves are trying to make you poorer, which is why SaveCalifornia.com is urging you to vote against all money-grabs.

Today, I want to explain why Democrat- and RINO-run cities are so tempted to make you poorer. I’m going to try to say it simply, with lots of evidence, and with a couple of cartoons to illustrate.

But first, please know I strongly support moral/ethical police officers and firefighters, and the necessary services they provide. Yet I adamantly oppose thieving union bosses and their prostituting city officials for the government waste, fraud, and abuse they promulgate.

Now for my explanation:

In California’s March 5 primary election, more than 100 local governments are trying to trick you out of your hard-earned money. These money-grabs are on your ballot in the form of tax increases, tax extensions, bonds, fees, or assessments. Yet all are deceptive and wasteful. Unless you vote no on all money-grabs, you’ll be taken advantage of and become poorer, while “public servants” become all the richer.

FACT:

The Pension Rights Center reported last October, based on U.S. Bureau of Labor Statistics data, that only 19 percent of American workers are in a pension plan.

So, despite the lie that government employees are underpaid “victims,” the following cartoon represents how most Californians — and Americans — in the workforce don’t have guaranteed pensions, and many younger employees aren’t even familiar with the idea.

MORE FACTS:

- In 2016, intrepid conservative researcher Steve Frank reported how lucrative pensions are making some California “public employees” very rich off the backs of financially-hurting taxpayers: “Updated numbers displayed at OpenTheBooks.com show there is a $2.8 billion annual cost to payout 21,862 six-figure public-sector retirees via CalPERS. It’s a massive payout equivalent to the combined income tax payments of nearly 1.6 million individual California taxpayers.”

- City employees in the police and fire departments can receive abnormally high salaries. For example, the Transparent California database reports that, in 2022, in Anaheim, seven fire chiefs and captains made from $477,762 to $671, 238 in total pay and benefits. Even in Fresno with lower housing costs, the “top brass” of city and fire departments in 2022 were paid $350,000 a year in total pay and benefits. Another example is in San Diego, where, in 2022, both a police sergeant” and a “police sergeant” were both paid more than a half million dollars a year in total pay and benefits.

- California state law (thank the corrupt, ruling Democrats) places the burden upon local governments, not police and fire deparments, to fund pensions. As one wealth management firm explains, in a defined-benefit plan: “The funds are guaranteed to the individual regardless of the performance of the investments in the larger pool, and the organization/business that you previously worked for is liable to cover the cost of all payments, even when the investment funds are unable to cover the cost.”

- This continually growing pension burden has resulted in overly-generous police and fire retirement pensions significantly pressuring city and county budgets, even threatening them with insolvency. In 2016, the California Policy Center wrote: “Five California counties reported that their pension contributions now exceed 10 percent of total revenues: Santa Barbara County (13.1 percent), Kern County (11 percent), Fresno County (10.7 percent), San Diego County (10.4 percent) and San Mateo County (10 percent) … A sixth county, Merced, is also expected to report that its required contributions topped 10 percent of 2015 revenue when it files its audit. We estimate Merced’s payments at slightly over 11 percent of revenue.”

Listen to fiscally-conservative professor of finance Joshua Rauh of Stanford University, who’s also a senior fellow at the Hoover Institution. Like me and others, he’s blowing the whistle on the unjust and evil union-boss-and-Democrat-Party-politicians pension scheme, including reporting updated numbers in 2019: “In California, more than 62,000 retired public employees are receiving pensions of over $100,000 per year.” Wow — these retired employees — your “public servants” — receive more not working than most working Californians receive.

EVEN MORE FACTS:

Because cities and counties are legally liable (a bad state law of prostituting Democrat state legislators, who are loyal to their union-boss pimps) to fund increasingly more “catch-up” payments into pensions, the real story is California cities are being crushed by fire and police department pensions.

As California Policy Center co-founder Edward Ring sagely reported in 2018, in a case study of the San Mateo County city of Millbrae: “Currently, as can be seen on the table, for every dollar it pays active employees in base wages, Millbrae must contribute 59 cents to CalPERS. This does not include payments to CalPERS that Millbrae collects from its employees via withholding. The same data show that, by 2024, for every dollar Millbrae pays active employees in base wages, they will have to contribute 89 cents to CalPERS. Put another way, while Millbrae may expect its payroll costs to increase by $1.4 million, from $6.3 million today to $7.7 million in six years, their payment to CalPERS will increase by $3.1 million, from $3.7 million today to $6.8 million in 2024.

But here’s the rub. Nearly all of this increase to Millbrae’s pension costs are the “catch-up” payments on the city’s unfunded liability. In just six years Millbrae’s payment on its unfunded liability will increase by 99%, from $2.9 million today to $5.8 million in 2024.

Why?

What are the implications?

It is difficult to overstate how outrageous this is. Here’s a list:

1 – Virtually every pension “reform” over the past decade or so has exempted active public employees from helping to pay down the unfunded liability via withholding. Instead, their increased withholding – in some cases supposedly rising to “fifty percent of pension costs” (the PEPRA reforms) – only apply to the normal contribution.

2 – In order to appease the unions who, quite understandably, lobby for the lowest possible employee contributions to pension funds, the “normal cost” is calculated based on financially optimistic projections. The less time an actuary predicts a retiree will live, and the more an actuary predicts investments will earn, the lower the normal contribution.

3 – In order to cajole local elected officials to agree to pension benefit enhancements, the same overly optimistic, misleading projections were provided, duping decision makers into thinking pension contributions would never become a significant burden on cities and counties, and by extension, taxpayers.

4 – Because cities and counties couldn’t afford to pay down the growing unfunded liabilities attached to their pension plans, tricky accounting gimmicks were employed, where minimal catch-up payments were made in the present in exchange for bigger catch-up payments in the future. The closest financial analogy to what they did would be the “negative amortization” mortgages that were popular prior to the housing crash of 2008.

5 – The consequence of this chicanery is that today, as can be seen, catch-up payments on the unfunded liability are typically two to three times greater than the normal contribution. And it’s getting worse. In 2024, Millbrae, for example, will have a catch-up contribution that is nearly six times as much as their normal contribution.

6 – When a normal contribution isn’t enough, and the plan becomes underfunded, the level of underfunding is compounded every year because there isn’t enough money in the fund earning interest. The longer catch-up payments are deferred, the worse the situation gets.”

What an unholy mess! Similarly, in September 2018, City Journal’s investigative journalism, “Policing Pensions,“ informed us (as well as gubernatorial candidate Gavin Newsom, but he didn’t listen) that “The League of California Cities recently reported that their members expect pension costs to rise by at least 50 percent over just the next half-decade. Cities employing police officers and firefighters will face the highest burdens: for every $100 spent in salary on current employees, they will soon have to shell out at least $54 to the state’s pension fund, CalPERS.”

Only four years ago, the threat of out-of-control police and fire pensions was threatening city and county budgets, and the threat is exponentially worse today (yet the Democrat Party rulers of California, loyal prostitutes to their union-boss pimps, have done nothing to solve this). As the June 2020 CalMatters article, “Surging pension costs push more California cities toward bankruptcy,” reported:

Three California cities have declared bankruptcy in recent years, and fast-rising pension costs have been major factors in all. One was Vallejo, whose recently retired city manager, Daniel Keen, joined his colleagues in seeking relief, saying he expected pension costs for police to reach 98 percent of payroll in a decade and hinting that Vallejo could slip into insolvency again.

A new study for the League of California Cities, conducted by a consulting firm, Bartel Associates, projects that over the next seven years overall city pension costs, excluding health care, will nearly double, reaching an average of 15.8 percent of their general fund budgets by 2024-25. Costs for police and fire personnel will climb to well over 60 percent of payroll.

“The results of this study provide additional evidence that pension costs for cities are approaching unsustainable levels,” Bartel’s report warns. As those burdens outstrip revenue growth, it says, “many cities face difficult choices that will be compounded in the next recession.”

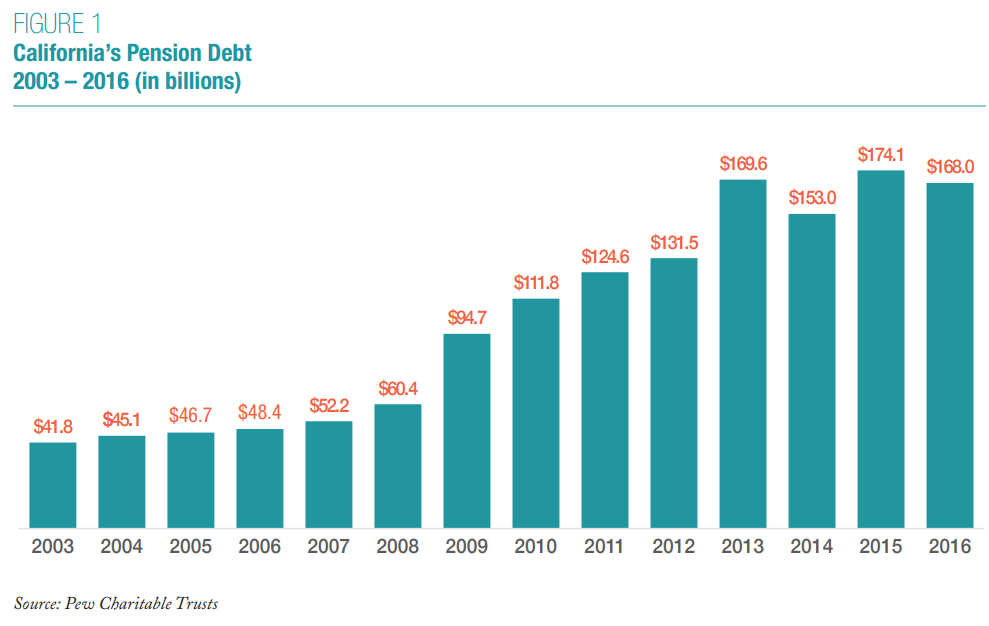

The chart below illustrates how California cities’ and counties’ pension debt for government employees (including police and fire department employees) dramatically increased with the pro-union bill signings of RINO governor Arnold Schwarzenegger in his second term (2007-2010) and after that, even higher during the first six years of Democrat governor Jerry Brown (2011-2019).

The harsh consequences upon local governments and taxpayers were explained in a 2018 paper by the Pacific Research Institute, which concluded: “In the end, political mandates cannot change economic realities. California can proceed as if the current promises of the public pension systems can be met, but there are costs of doing so. These costs, which will be imposed on future generations, will include higher tax burdens, bleaker economic prospects, and fewer core public goods and services.”

The creative, scary, and fuzzily-rendered cartoon below illustrates union bosses’ and their Democrat Party politicians’ monstrous cannibalization of city budgets, which your city councilmembers and county supervisors won’t tell you about.

| Bottom line, when local candidates are endorsed by police and fire unions and win, they are “bought politicians” who will never go against their union-boss masters. So, because these anti-people Democrat or RINO politicians think your money is theirs, they come after you for it. Nearly every election season, they lie that they need to improve roads, sewers, water facilities, roofs, infrastructure, “save the library,” or whatever they feel they have to say to deceive and coax more taxes, bonds, fees, assessments — more money — from the uninformed citizenry. And because these Democrat and RINO politicians are “bought” by the police and fire department unions, they hardly ever admit that government waste exists — when it surely does. Yet there is a just and sure way to escape this lying, thieving stranglehold — but it’s probably going to take a well-drafted (without “holes”) state constitutional amendment in California that the people approve for the sake of fairness and protection from thieves. As the Winter 2013 City Journal article, “The Pension Fund That Ate California,” explains: “CalPERS and its legislative allies keep resisting the one reform that would truly free California taxpayers from this ruinous pension system: moving it toward a 401(k)-style defined-contribution plan, as other states and municipalities, including Utah and Rhode Island, have done. In a defined-contribution plan, the government’s commitment ends after it makes its annual required contribution into a worker’s retirement account; the taxpayer’s liability also ends there. Under the CalPERS regime, by contrast, employees are guaranteed benefits even if the government hasn’t put aside money to pay for them, placing all the future liability on the taxpayer.” PLEASE TAKE ACTION: STEP 1: This March 5, 2024 California primary election, please oppose all money-grabs (any and all tax increases, tax extensions, bonds, fees, and assessments). Tell the thieves and liars “no more!” Instead, demand real fire and police department pension reform and tough, waste-finding conservative audits from outside of California. Please share my email with others and also share our special site, SaveCaliforniaElection.com. STEP 2: Because of how unions and their “owned politicians” put deceptive tax hikes on the ballot, and since union bosses regularly spend union dues to elect and re-elect corrupt Democrat Party politicians, if you’re a union member, please resign from your union. You have the legal right to do so, while keeping your job, benefits, and more of your own money. Here’s how government employees can get out and here’s how private sector employees can stop funding the beast. |

In the Bible, God commands respect for ownership rights and contractual rights

“For the kingdom of heaven is like a landowner who went out early in the morning to hire laborers for his vineyard. Now when he had agreed with the laborers for a denarius a day, he sent them into his vineyard. And he went out about the third hour and saw others standing idle in the marketplace, and said to them, ‘You also go into the vineyard, and whatever is right I will give you.’ So they went. Again he went out about the sixth and the ninth hour, and did likewise. And about the eleventh hour he went out and found others standing idle, and said to them, ‘Why have you been standing here idle all day?’ They said to him, ‘Because no one hired us.’ He said to them, ‘You also go into the vineyard, and whatever is right you will receive.’ “So when evening had come, the owner of the vineyard said to his steward, ‘Call the laborers and give them their wages, beginning with the last to the first.’ And when those came who were hired about the eleventh hour, they each received a denarius. But when the first came, they supposed that they would receive more; and they likewise received each a denarius. And when they had received it, they complained against the landowner, saying, ‘These last men have worked only one hour, and you made them equal to us who have borne the burden and the heat of the day.’ But he answered one of them and said, ‘Friend, I am doing you no wrong. Did you not agree with me for a denarius? Take what is yours and go your way. I wish to give to this last man the same as to you. Is it not lawful for me to do what I wish with my own things? Or is your eye evil because I am good?’”

Jesus Christ, Savior of the world and God in the flesh, in Matthew 20:1-15

“Prosperity cannot be restored by raids upon the Public Treasury.”

Herbert Hoover, 31st U.S. president (1929 to 1933) in his December 9, 1930 speech

“A democracy cannot exist as a permanent form of government. It can only exist until the majority discovers it can vote itself largess out of the public treasury. After that, the majority always votes for the candidate promising the most benefits with the result the democracy collapses because of the loose fiscal policy ensuing, always to be followed by a dictatorship, then a monarchy.”

Attributed to Scottish advocate/judge/writer/historian Alexander Fraser Tytler (1747-1813)

RSS 2.0 Feed

RSS 2.0 Feed